A Real-Life M&A Disaster

The deal closed. The press release went out. And then leadership moved on to the next priority.

Within weeks of the deal close, sales teams globally were asked at the annual sales kickoff to sell newly acquired technology they did not understand. Despite me urging leadership to slow down and properly lay the foundation, no one had clearly defined how it fit into the portfolio, who it was really for, or what it cost customers to deploy it. The directive was that speed mattered more than clarity.

“Just get it in front of customers. We’ll figure it out later.”

What happened next was a pattern I have seen more times than I can count.

Customers immediately sensed the uncertainty and confusion. Deals stalled. Credibility eroded. Internally, confidence cracked as teams were pushed to represent an offer leadership itself could not clearly articulate.

And in just a few months, the “new, hot technology” that was deemed to transform the business was quietly sidelined. Not because it lacked value. But because the organization never aligned around how to sell it or clearly articulated how it fit into the customer journey.

Eventually, the founder of the new technology, who joined the business through the acquisition, was pushed out because there was no longer a place for him.

And the acquiring company lost the growth it paid for.

Why This Keeps Happening

Public companies, founder-led businesses, and mid-market growth companies are increasingly using M&A to enter new markets, acquire capabilities, and accelerate revenue.

The assumption is simple. Buy growth, integrate fast, scale.

What often follows is slower pipeline, confused customers, disengaged teams, and a longer, riskier path to organic growth.

WHY? Well, it’s not because the investment thesis was wrong.

It is because growth-side integration was treated as secondary to finance and legal, and leadership attention was diverted to internal power dynamics instead of commercial execution.

After nearly 30 years helping companies integrate and scale through acquisition, including serving as CMO inside a PE-backed rollup of 20 acquired companies, the pattern is clear.

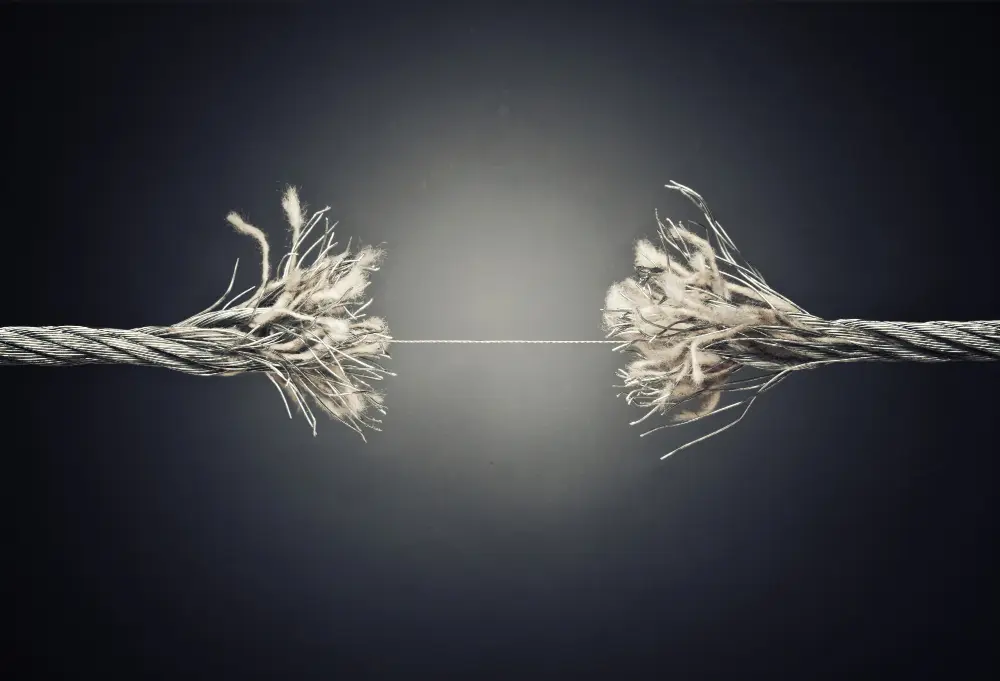

When brand, go-to-market, onboarding, and culture are not documented and aligned early, growth quietly leaks.

And that growth leak is EXPENSIVE!

The Integration Reality CEOs Underestimate

From the outside, customers often assume clarity has been identified the moment the deal is announced. From the inside, employees experience ambiguity the moment the deal closes. And teams immediately begin asking questions that leadership often assumes are already answered:

- Who are we really selling to now?

- What problem do we lead with?

- Which brand story wins?

- How do our offers actually fit together?

- What does success look like in this new company?

When these questions go unanswered, internal teams default to what feels safest and what they already know. And that legacy messaging, legacy ICPs and legacy incentives create complexity instead of compounding growth.

What CEOs Must Do as They Contemplate M&A

If you want acquisitions to accelerate growth instead of quietly undermining it, there is one question you must be able to answer clearly BEFORE THE DEAL CLOSES, assuming the economics make sense:

How does this make it easier for customers to buy from us?

Not eventually. Not in theory. In practice.

That answer should guide every integration decision that follows.

To do that well, CEOs must take ownership of a few non-negotiables:

- Be explicit about what will change and what will not. Do not protect comfort at the expense of clarity.

- Treat brand and go-to-market as integration infrastructure, not marketing tasks.

- Ensure leaders are truly equipped to run what they inherit. Titles and proximity to the CEO do not create confidence. Competence does.

- Align incentives before asking for new behavior. People do what they are paid to do. Full Stop!

- Communicate like growth depends on it, because it does.

- Protect the customer experience during the transition. Trust lost here is slow and expensive to rebuild.

Once that foundation is clear, execution matters. Companies that acquire and integrate businesses well, consistently do the following six things.

1. Define a Single Commercial Truth Early

Before touching websites, logos, or org charts, strong acquirers align on four fundamentals:

- The primary ICP going forward

- The category and point of view the combined company owns

- The value creation story of the acquisition

- The offer architecture customers should clearly understand

This creates a shared definition of growth. Without it, each acquired team continues selling its own narrative, resulting in conflicting messages to the same customers and unnecessary friction in the buying process. And yes, friction is a drag on revenue.

2. Choose Brand Architecture Based on Growth Strategy, Not Convenience

Trying to operate as “one company” while maintaining multiple, fully independent brand stories confuses the market and exhausts teams.

Companies that successfully grow through acquisitions make an intentional choice of becoming:

- A branded house when scale and cross-sell matter

- A house of brands when buyers are truly distinct

- An endorsed brand when speed matters now and consolidation comes later

Brand architecture is not a design decision. It is a go-to-market decision.

3. Operationalize One Voice Across the Revenue Engine

Alignment only works when teams can actually use it. Winning companies create a shared messaging system that includes:

- A clear North Star narrative

- Proof tied to outcomes, not claims

- ICP-specific pain and value language

- Objection handling grounded in reality

- Clear guidance on what legacy language no longer applies

This system fuels EVERY PART OF THE ORGANIZATION, including sales, marketing, onboarding, customer success, and partnerships.

4. Treat Employee Alignment as a Growth Lever

Internal clarity is revenue infrastructure. Let me say that again.

INTERNAL CLARITY IS REVENUE INFRASTRUCTURE!!!

High-performing integrations focus on:

- Clear ownership of pipeline, pricing, onboarding, and retention

- Decision rights that reduce friction instead of escalating everything upward

- A consistent operating cadence

- Enablement that ensures teams understand the new reality and how to win in it

Psychological safety matters here. One-way communication and psychological safety are polar opposites. Ambiguity and fear do not create trust. Transparency and clarity do.

5. Communicate Relentlessly, Then Systematize It

The best integrations communicate like a product launch.

They set expectations clearly on Day One, provide frequent updates early, equip managers to lead consistent conversations, and create real feedback loops.

6. Fix the Customer Journey Before Scaling Demand

Onboarding is where brand promise becomes real. Strong acquirers align:

- Sales-to-delivery handoffs

- Onboarding expectations and timelines

- Support and escalation models

- Success metrics tied to time-to-value and retention

This is where most acquisitions quietly bleed value.

The Bottom Line

M&A creates potential. Alignment converts that potential into growth.

Whether you are PE-backed, founder-led, or publicly traded, the risks are very similar.

If your company does not speak with one voice, operate with clarity, and bring the team along deliberately, growth slows even when the investment thesis is right.

Alignment is not optional. It is a critical element of the growth strategy.

So, if you are contemplating an acquisition or integrating one right now, there is a narrow window where growth is either protected or quietly compromised. If you want to know whether your M&A strategy is compounding value or quietly leaking it, let’s talk before the pipeline, the people, or the customer tells you first.

Book a Growth Alignment Session or email sheraun@brittonparris.com to get started today.