If you are running a mid-market business with revenues of $10M+, you have probably felt this shift.

Growth used to feel simpler.

Deals closed faster.

Referrals came in more consistently.

Marketing worked, even when it was scrappy.

Now, despite doing more, growth feels heavier and harder.

Sales wants better leads.

Marketing wants more budget.

Customers need more hand-holding.

And somehow, you are still the one holding it all together.

That is not a failure of effort.

It’s a sign your go-to-market model has outgrown its original shape.

Why GTM Breaks at This Stage

At this stage, companies are no longer winging it, but they are not fully systemized either.

You likely have:

- A defined ICP, even if it is broader than it should be

- A sales process that sometimes works

- A handful of channels that delivered growth in the past

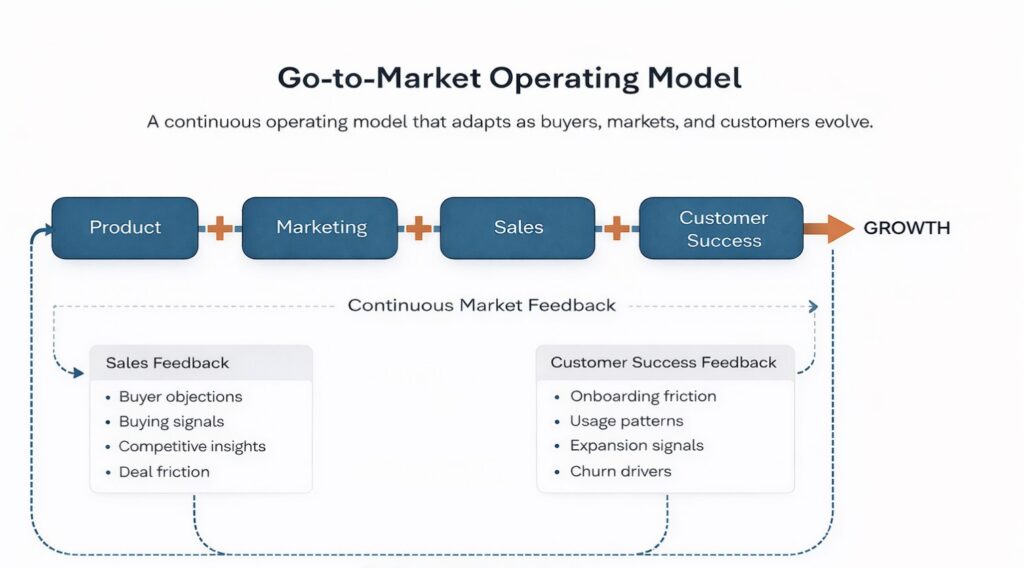

What you likely DO NOT have is a go-to-market system like this one, that adapts as fast as the business itself.

At $10M+, companies are stuck in the messy middle, too big to rely on founder intuition alone, too small to absorb inefficiency like an enterprise.

For years, GTM was treated as a phase:

- Launch the offer

- Push demand

- Move on

That worked when the founder was the system.

It breaks the moment the company needs to scale beyond you.

The Buyer Has Changed, Even If Your GTM Hasn’t

Today’s buyers take their time.

The average B2B buying journey now spans six to nine months, with buyers engaging across ten or more touchpoints before speaking to sales.

This shift is measurable. Forrester research shows the median B2B buying cycle has stretched from 8.2 months in 2016 to 11.3 months in 2024. Even when mid-market cycles are shorter, the complexity is the same and the margin for error is far smaller.

For a mid-market company, that means:

- Prospects disappear and reappear without warning

- Sales cycles stall for reasons no one can fully explain

- “Good leads” convert less reliably

Nothing is broken. The market is simply more complex.

And, what often gets missed is that only about 5% of your ideal customers are actively shopping at any given time. The rest are watching, learning, and forming opinions long before they raise their hand.

If go-to-market only shows up at launch or campaign time, your team is reacting instead of learning.

The Cost You Actually Feel

This does not show up as a clean dashboard metric. It shows up as:

- More conversations required to close the same deal

- Sales reps improvising the pitch

- Marketing chasing tactics instead of signals

- Customers needing more onboarding than expected

- You stepping in to smooth things over

One of the most expensive symptoms shows up in hiring. New sales reps often take five to six months to ramp, not because they lack talent, but because what actually closes deals lives in tribal knowledge, not a documented GTM system. At this stage, slow ramp time quietly taxes growth and cash flow.

These are all symptoms of treating GTM as a moment instead of a system.

Companies that continuously optimize their go-to-market approach see higher lifetime value and lower churn, not because they are bigger, but because they stay aligned.

Why “We’ll Fix It Later” Is Risky

Many founders assume this becomes important at $50M or $100M.

By then, habits are locked in.

At $10M+:

- Small misalignments have outsized impact

- Every dollar must work harder

- Every hire either adds leverage or friction

Waiting does not simplify GTM. It compounds the mess.

What “GTM as a System” Means at This Size

This is not about adding layers or slowing things down.

It is about reducing noise.

A permanent GTM operating model at this stage means:

- One clear story told consistently by sales, marketing, and customer success

- Regular feedback loops from sales calls and customer conversations

- Fewer launches and more refinement

- Adjusting positioning before performance drops, not after

- Getting out of the business of constant resets

This is how growth becomes steadier without becoming heavier.

The Founder Test

Ask yourself:

- Would deals still close if I stepped back for 90 days?

- Would messaging stay consistent without my involvement?

- Would customers have the same experience without escalation?

If the answer is no, your GTM system is still living in your head, which is not scalable.

The Four Pillars of Continuous GTM for Mid-Market Companies

You don’t need enterprise budgets or a large team. You need discipline, documentation, and a quarterly operating rhythm.

1. Build a Living ICP, Not a Static Persona

- Review your last 30 closed deals and top 20 retained customers. If they no longer match your ICP from 6 to 12 months ago, your targeting has drifted.

- Segment by outcomes, not demographics. Focus on who closes fastest, ramps quickest, and churns least.

- Use a simple ICP scorecard. Label every deal strong fit, marginal fit, or off profile. Require executive approval for off-profile deals. This alone can lift win rates by 20% to 30%.

- Share ICP insights across teams. Your ICP is a company operating truth, not a sales artifact.

2. Document the Sales Process You Actually Use

- Interview your top three performers. Capture buyer questions, objections, proof points, and language that closes.

- Create a one-page messaging framework used by sales, marketing, and customer success.

- Maintain a living competitive document that tracks losses, positioning gaps, and competitor strengths.

- Map the real customer journey, including where evaluation stalls and onboarding falls short.

3. Align the Revenue Engine on Shared Definitions

- Hold a bi-weekly GTM review with marketing, sales, product, and customer success.

- Align on shared metrics such as win rate by ICP, CAC, LTV, time to ramp, and churn by segment.

- Clarify handoffs so what is promised, sold, and delivered matches.

- Build a simple onboarding playbook so new reps are productive in 60 to 90 days.

4. Create a Feedback System That Captures Market Signals

- Debrief every lost deal and feed insights back into messaging and enablement.

- Track churn deeply and identify unmet expectations.

- Study how your best customers actually use your product or service. Unexpected patterns are signals.

- Use lightweight competitive tracking. Doesn’t have to be fancy, or the new SaaS tool. Discipline matters more than the actual tools.

Bottom Line

This is not about sophistication or theory.

It is about protecting momentum without burning you or your team out.

Go-to-market does not need to be bigger. It needs to be continuous.

That is how good mid-market companies (with solid product market fit) create sustainable growth.